Features

State of the Nutraceuticals Industry: Strength and Stability Position Market for Long-Term Success

Our fourth annual survey finds continued growth due to consumer demand for health products, in spite of ongoing logistical challenges.

By: Sean Moloughney

Inflation, supply chain nightmares, labor shortages, and more have tested the resolve of businesses across industries in 2021. Two years since the emergence of COVID-19, the nutraceuticals market has benefited from increased demand for wellness products that target immune function in particular, but also preventive health in general.

While the sales spikes of 2020 have come back down to earth in 2021, people continue to invest in dietary supplements and personal health products. Companies have been challenged to meet even more moderate demand, faced with supply chain bottlenecks and a scarcity of certain ingredients, components, and workers.

To take the temperature of the nutraceuticals industry, and better understand critical issues affecting business today, we at Nutraceuticals World conducted our fourth annual audience survey in October and November 2021. We received responses from 139 qualified industry members working at companies that either manufacture, market, or distribute finished nutraceutical products—such as dietary supplements, functional foods, or nutritional beverages—supply raw materials, or provide services directly related to these markets and products. The charts and graphics on the following pages depict results.

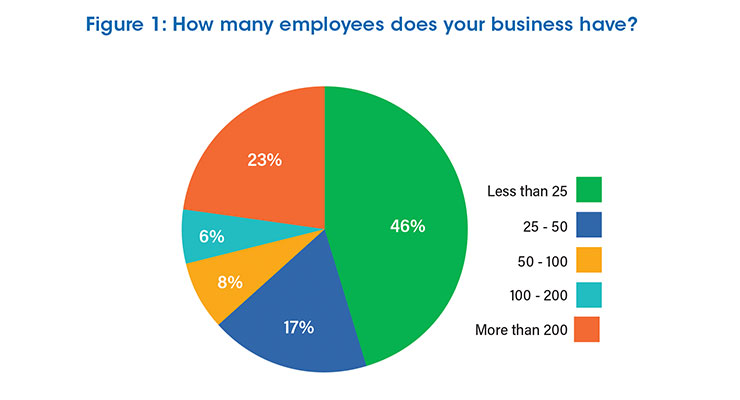

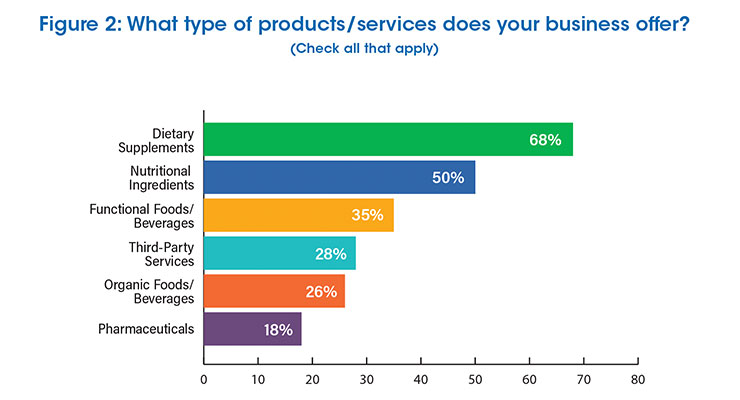

Nearly half of people that completed this survey work with small businesses with less than 25 employees (46%), while another 23% work with large firms that employ more than 200 (Figure 1). Two-thirds market dietary supplements (68%), and half supply nutritional ingredients (50%) (Figure 2).

Confidence & Concerns

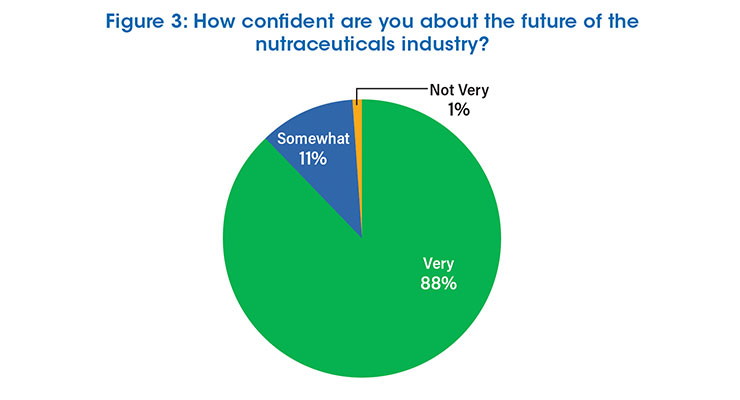

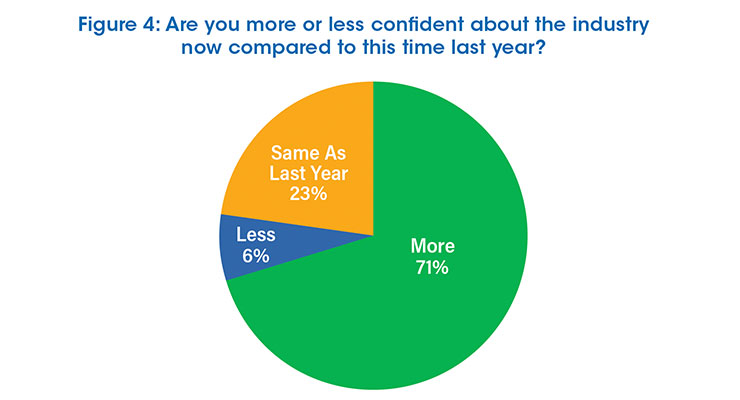

While COVID-19 continues to present a host of unique challenges, particularly when it comes to supply chains, companies are overwhelmingly confident about the future of the nutraceuticals industry. In fact, 88% of respondents said they are “very” confident in the future (Figure 3). Additionally, 71% said they are more confident about the industry now compared to the same time last year; 6% were less confident; and 22% said their confidence remained unchanged (Figure 4).

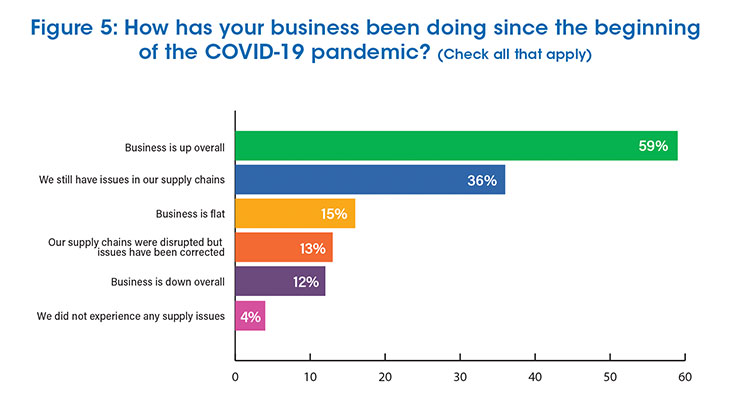

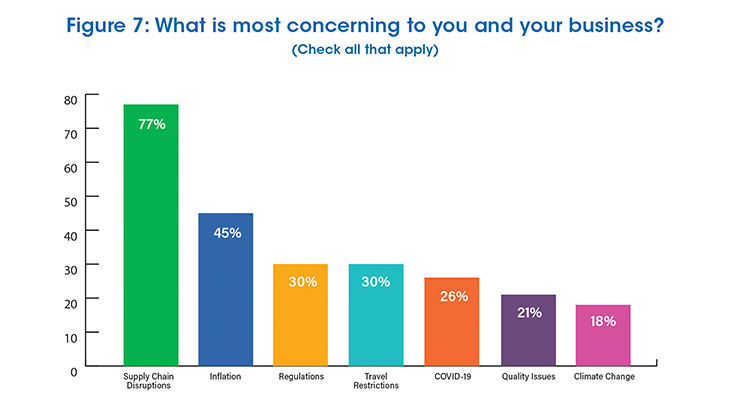

In terms of how COVID-19 has affected bottom lines, 59% said business is up, (an increase of 14 points from last year), 15% said business is flat, and 12% said business is down (Figure 5). As for supply chains, 36% said they still have issues in their supply chains today, while 13% reported disruptions that have since been corrected (Figure 5). Not surprisingly, supply chain disruptions were the number one concern among respondents (77%) for the second straight year (up from 67% last year).

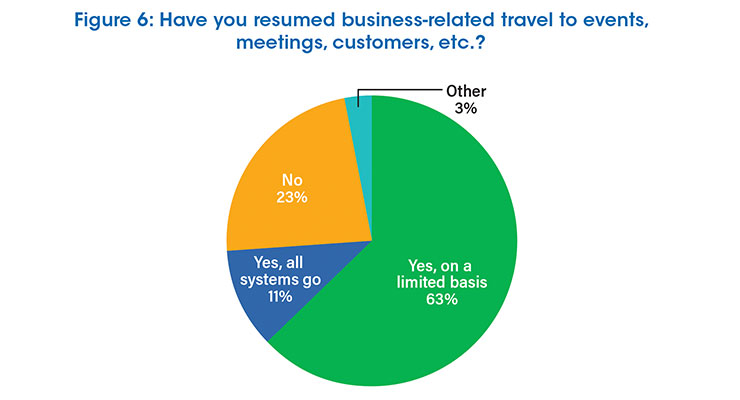

Following a long hiatus of in-person industry events, 63% said they have resumed business-related travel on a limited basis; 11% have resumed traveling without self-imposed restrictions; 23% said they still have not resumed business travel to events, meetings, customers, etc. (Figure 6).

Following supply chain issues (77%), the industry’s most pressing concerns included inflation (45%), regulations (30%), travel restrictions (30%), COVID-19 (26%), quality issues (21%), and climate change (18%) (Figure 7).

Expectations & Initiatives

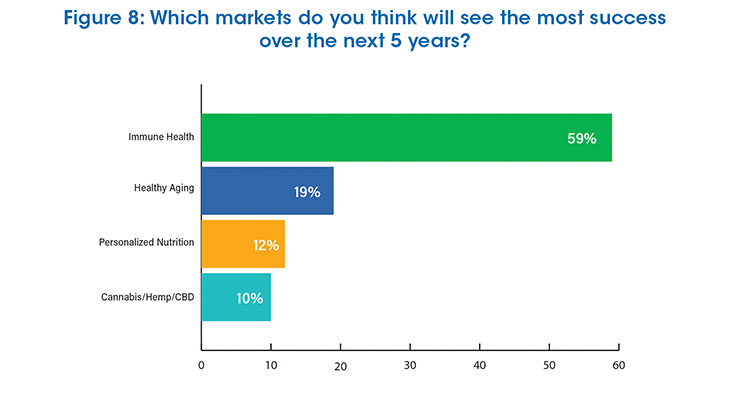

Asked which markets they think will see the most success over the next 5 years, immune health was the clear winner (59%), followed by healthy aging (19%), personalized nutrition (12%), and cannabis/hemp/CBD (10%) (Figure 8).

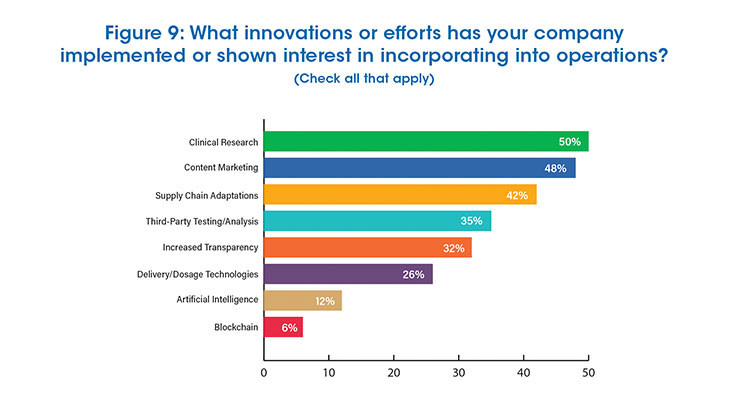

In terms of innovations or efforts companies have implemented or shown interest in incorporating into their business, clinical research led the way with 50%, followed by content marketing (48%), supply chain adaptations (42%), third-party testing/analysis (35%), increased transparency (32%), and delivery/dosage technologies (26%) (Figure 9).

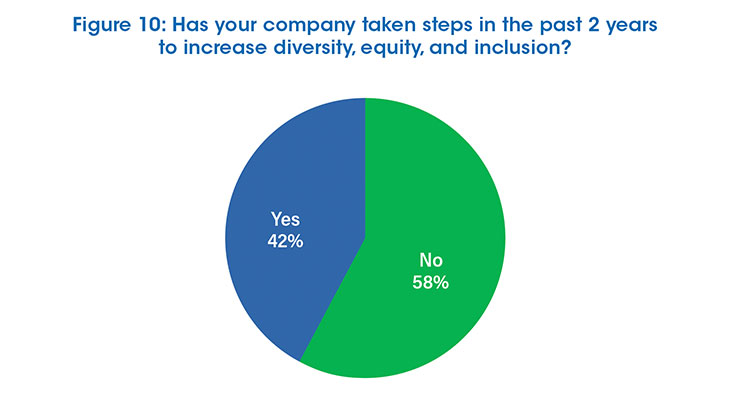

Asked if their company has taken steps in the past 2 years to increase diversity, equity, and inclusion, 42% said yes, citing hiring practices, workplace culture, and leadership inclusion, among other initiatives (Figure 10).

Unique Insights

Prompted to offer their own thoughts about the state of the nutraceuticals industry, responses reflected that industry is in a unique position to respond to a growing base of consumers focused on health and wellness.

“Personal health is a top priority, especially so in a pandemic situation. Hence, the industry is going to grow by leaps and bounds in the coming years,” one respondent wrote.

“It is a great but challenging time to be in this industry,” said another. “Consumers are looking to the industry more and more for support with their health and wellness goals and trust is continuing to build.”

Several survey respondents said while the industry is strong and growing, supply chain issues are concerning, and have held back innovation and product launches. “The industry still has a lot of issues with production. We are seeing increased demand for natural and holistic in both supplements and grocery. While sales are strong post-COVID, there is still uncertainty in the market. Staffing issues are also plaguing us.”

Another wrote, “Massive spike in demand from consumers during a time when supply chains are already taking a hit has created some interesting challenges. Despite that, it seems there is more space for emerging brands to differentiate by paying attention to sustainable and ethical supply chain, packaging, mission.”

Overall, respondents suggested the industry is in a strong position to meet needs of consumers looking for quality, science-backed products in unique delivery forms.

“The dietary supplement industry is continuing to mature. Transparency is continuing to evolve, and the self-policing necessary to support that transparency is occurring. Accountability by all components of the supply chain is improving. In general, the dietary supplement industry has gained a greater awareness and respect due to our reaction and contribution to the health and welfare of people during the pandemic.”

Another wrote, “The industry is well placed to serve the ever increasing demand for healthy and nutritional products. Health as a megatrend is stronger than ever, and we have the opportunity to serve a whole new customer base looking for a healthy lifestyle.”

“Overall, it is a great time to be in the nutraceutical industry,” one person said. “Folks are increasingly drawn to nutraceuticals to address their overall health care. Millennial and younger generations value preventative care over emergency care, in general, and do not trust big pharmaceutical companies to have their best interests at heart, which leaves an opening for nutraceuticals to display how they are different: closer to nature, accessible, and steeped in tradition.”