Features

Digesting the Gut Health Market and a Bundle of Biotics

The vital link between supplement manufacturers and consumers can help companies develop solutions that meet high expectations.

By: Sheila Rizzo

The gut health movement is booming. Powered by consumers’ fascination with holistic, inside-out wellness, the global digestive supplement market reached a value of $47.8 billion in 2022 and is predicted to grow a further 8.2% by 2030.

In the midst of this growth, however, the question remains: how well do consumers really understand gut health and what the market offers? With hundreds of products crowding the shelves, it can be difficult for shoppers to differentiate prebiotic from probiotic supplements and exactly what benefits they can expect from either.

There is a crucial opportunity here for supplement producers to educate and be educated. By more clearly outlining the features and benefits of various gut health products, brands can turn promising growth into exponential success. At the same time, it’s imperative that product manufacturers foster a closer relationship with consumers, listen to their needs, and better understand what they’re looking to address, achieve, or support from a gut health perspective.

It’s going to take time and effort to commit to this two-way education stream, but the rewards will be game-changing. Read on as we explore the key definitions brands need to make clear to consumers and the top insights they can glean in return by getting better acquainted with their customers’ gut-health concerns.

A Bundle of ‘Biotics’

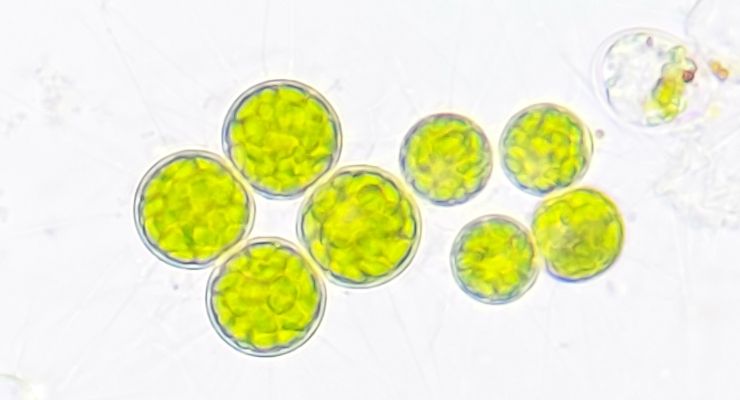

First things first. Let’s nail down some definitions:Probiotics: live, viable microorganisms found in foods, supplements or any product designed to provide health benefits when consumed, generally by improving or restoring the gut microbiota present in the body.

Prebiotics: products containing nondigestible food ingredients that selectively stimulate the growth or activity of bacteria indigenous to an individual’s body.

Postbiotics: nonviable bacteria or metabolic byproducts from probiotic microorganisms that produce biologic activity within the body.

Even laid out in plain terms like this, it is easy to see how consumers can confuse so many similar-sounding ingredients. In terms of mainstream penetration, probiotics have a significant head start with 67% of respondents to the International Food Information Council’s (IFIC’s) 2021 Food and Health Survey claiming familiarity with probiotics, and over a third stating they were actively working to increase their consumption.

The survey paints a very different picture for the other biotics with 32% and 18% stating they were unfamiliar or had never heard of prebiotics respectively, and 35% reporting a lack of knowledge around postbiotics. Supplement brands may have been successful in pushing gut health to the top of the priority list, but there is clearly work to be done in helping consumers understand the various solutions on offer.

So, what key messages do producers need to get across to consumers for each of the biotic categories?

The Power of Prebiotics

The second largest ingredient category in the gut health space, prebiotics, are often seen as the fuel that keeps the microbiome healthy. More catalysts for gut health than active ingredients, research nevertheless shows some significant benefits to prebiotic consumption.A study on galactooligosaccharide (GOS)—a type of prebiotic— for instance, found that participants experienced reduced complaints of gas, bloating, and abdominal pain compared to the placebo group, while a separate investigation into the effect of GOS supplementation in young adult women showed a reduction in anxiety symptoms over the course of the trial.

For most healthy individuals, a balanced diet, rich in high-fiber foods, such as lentils, bananas and oats, is enough to keep prebiotic levels stable. Thanks to their relative abundance and the fact they work in tandem with probiotic bacteria to produce a beneficial effect, prebiotics make an ideal secondary inclusion—turning a simple probiotic supplement into a multifunctional synbiotic (combination of probiotics and prebiotics).

Endless Pro-tential

Probiotics are one of the best-known gut health ingredients, lauded by consumers around the world for their tangible health-supporting effects. An important point to stress regarding probiotics is specificity, as many of the benefits assigned to the entire category are in fact unique to certain bacterial strains.Lactobacillus rhamnosus GG, for instance, has been shown to alleviate the symptoms of irritable bowel syndrome (IBS), including bloating and abdominal pain, without causing significant side effects in numerous trials.

In the context of a growing demand for all-in-one health solutions, gut health supplement brands can take advantage of highlighting the multitude of health areas in which probiotics can make a positive impact. From immune support and cholesterol reduction to improved mood management and sporting endurance, the evidence of probiotics’ value far beyond the gut has accelerated over the past decade.

In addition, the expanding interest and demand in overall holistic wellbeing products combined with probiotics create a tremendous opportunity for digestive health supplement brands— providing they can clearly and effectively communicate the multiple health benefits to consumers.

Postbiotics: A New Top-Trend Contender?

If probiotics are worker bees, and prebiotics are the nectar that feeds them, then postbiotics are the honey that’s produced at the end of all that labor.Though this biotics category is the least understood by the average shopper, these inanimate or nonviable microorganisms are starting to gain ground. Indeed, the market for foods and beverages containing postbiotics is predicted to grow by 10.1% CAGR up to the end of the decade.

Immunity, or a perceived lack thereof, is a critical factor here. While we should be wary of viewing every contemporary trend through the lens of COVID-19, the pandemic has had an undeniable impact on mainstream knowledge of, and focus on, immune health. Chronic inflammation—or an unresolved, prolonged reaction to tissue injury that persists well beyond the initial insult—has become a particular cause for concern, with consumers increasingly drawing a link between elevated levels of inflammation and increased susceptibility to infectious diseases.

It’s this connection that has spurred the popularity of postbiotics. With credible evidence pointing to the capacity of specific strains like saccharomyces cerevisiae to reduce inflammatory response and assist with inflammation resolution, postbiotics hold significant potential to be the next star ingredient for immune-support supplements. Even better: since they contain no living organisms, postbiotics are more resilient in the face of process- and storage-related stresses, making them a more shelf-stable prospect for producers and end-users alike.

Innovation Flows Both Ways

Improved gut health, strengthened immunity, higher supplement sales—there’s much to be gained from helping consumers better understand the various biotic categories, but shoppers have as much to teach product manufacturers as they have to learn.Excepting stricter regulatory and testing standards, perhaps the biggest difference between pharmaceutical and nutraceutical products is how influenced the latter is by consumer preferences. In the dietary supplements market, the pace of change more often than not is dictated by buyers, voting with their purchases on the types of ingredients, formats, and positionings they want to see. As such, it’s vital for nutraceutical producers to listen to and truly understand consumer needs if they want to rise above the competition.

What Consumers Want: Functions and Formats

In the spirit of two-way education, let’s first discuss functionality. As alluded to previously, most consumers now see probiotics as the solution for addressing digestive health. Over the last few years though, we’ve seen this definition expand.As awareness grows for the gut microbiome’s role in regulating a host of bodily functions—from sleep quality to mood, focus and immunity, so too does the value of probiotics in the nutraceuticals space. The probiotics market today is therefore one where claims like “mental clarity,” “immune support,” and “stress relief” are as popular as digestive regularity.

On the format side, we’ve witnessed consumer preferences shift away from traditional swallowable pills and capsules towards more fun-and-functional offerings, like chewable tablets and gummies. The reasoning underpinning this shift is obvious; the more convenient and enjoyable the format, the more accepted the supplement.

Consumers are also becoming far more discerning about what they allow into their bodies, a trend we can see reflected in the rise of personalized supplements. Often harnessing the power of 3D printing and other smart production technologies, solutions like customized gummy stacks offer individuals the exact dose of the specific ingredients they need to fulfill their nutritional goals.

The top takeaways for brands? Stay up to date with the latest health and wellness trends and catch the wave just before it breaks into the mainstream with products that prioritize convenience, enjoyment, and tangible results.

Building on a Solid Foundation

So, now we know; mutual understanding between supplement producers and consumers can help give everyone a good gut feeling. But there is one final consideration to keep in mind.Once effective two-way education has been achieved, the next big task for supplement manufacturers is to make sure their products live up to shoppers’ expectations, which thanks to better communication are higher than ever. No matter how on-trend or advanced a biotic solution is, it is functionally useless without the right delivery system to ensure it’s alive when it reaches the GI tract and ready to impart its intended benefits.

At Roquette, it’s our mission to guide manufacturers forward into this new era for nutraceuticals with our extensive range of inherently safe, international pharmacopeia, and Food Codex Compliance (FCC) approved excipients. One such example is our recently developed PEARLITOL ProTec co-processed mannitol-starch, a revolutionary excipient solution specifically designed to protect sensitive APIs like probiotics. With a portfolio brimming with tailored solutions like this and a commitment to solving the toughest challenges in drug delivery, we’re primed to help brands turn innovative concepts into the next must-have pre- or probiotic supplement.

Sheila Rizzo is the Global Strategic Market Manager at Roquette. For more information: www.roquette.com