Exclusives

Danone vs Nestlé: Billion Dollar Health & Wellness Businesses at a Glance

Companies strive to develop and grow nutrition, HW segments.

By: Hope Lee

Recently, we have seen the publication of Nestlé and Danone’s financial results for Q4 and full year 2015, which is a good time to take a quick look at where they stand in the global health and wellness (HW) market, according to Euromonitor International’s latest findings. Both companies are striving to develop and grow nutrition and health and wellness businesses and face similar opportunities and challenges that emphasize their strengths and weaknesses.

Overall, The Coca-Cola Co continues to lead the global HW market in 2015 with its Diet Coke and Coca-Cola Zero brands; however, Coca-Cola saw its market share noticeably eroded over 2010-2015, affected by the sluggishness of low-calorie cola. Second-ranked PepsiCo generally maintained its market share, thanks to its presence in both HW packaged food and HW beverages. From a HW perspective, PepsiCo seems to benefit from its wider HW portfolio compared with Coca-Cola’s sharp focus on soft drinks. Nestlé and Danone are primary competitors and both have a strong presence in HW bottled water and baby food.

Latin America: An Exciting HW Dairy Market for Danone

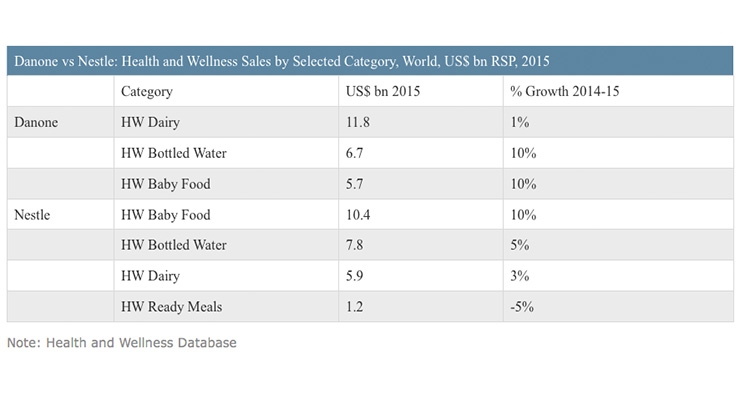

The table below illustrates global HW sales by selected categories of Danone and Nestlé in 2015. HW dairy is Danone’s biggest sales generator, but the company experienced a mixed performance in different regions. In Danone’s core HW dairy markets of Western Europe and North America, the company appeared to struggle with little improvement in sales in 2015. In recent years, Danone has faced problems in its traditional EU markets, including slow economic recovery, price pressure from chained retailers and tightening control on HW marketing and product development from the EC.

Increasing its presence in emerging markets will therefore continue to be a strategic priority. Latin America has emerged as an exciting market for Danone, underpinned by several mega brands, including Activia, Danonino, Paulista and Actimel. Activia doubled its sales over the past five years, reaching $1.3 billion in 2015. Among all Danone’s HW dairy brands in Latin America, Actimel was the best performer in 2015, according to Euromonitor International’s Health and Wellness database.

Danone and Nestle’s Core HW Categories, World Sales, 2015

China: A priority HW Market for Nestlé

HW baby food is the largest contributor to Nestlé’s global sales in 2015, with two strong brands, S-26 and Nan. In terms of regional sales, Asia-Pacific and Latin America are instrumental in shaping Nestlé’s baby food business. In China, the acquisition of Yinlu (local beverage company) and Pfizer’s baby food brands has provided new platforms for future growth. China’s relaxation of the one-child policy has created some exciting opportunities as middle class parents aspire to purchase quality brands, although the uptake of the new policy may not be as huge as anticipated. In 2015, Nestlé maintained its leadership in HW baby food in China, with a share of 14%, compared to Danone’s 8%.

Bottled Water: Both See Growth in International Brands

In global HW bottled water, Danone trails behind Nestlé by around two percentage points in 2015. Nestlé holds the number one position in HW carbonated water and still water. Nestlé is particular strong in carbonated water while Danone leads HW flavored water. In Nestlé’s full year 2015 results, it reported that the premium international brands, Perrier and S Pellegrino, continued their good growth momentum, creating additional value. Similarly, Danone also has its two distinctive brand portfolios: mass market (Aqua) and premium (Evian and Mizone).

As water-filtering devices are increasingly used by households in both developed and emerging markets, bulk water sales could potentially be affected in the long-term. However, natural mineral water with an emphasis on origin and specific source for on-the-go consumption, may continue their growth in the medium term. In terms of geographical coverage, both companies need to address their weakness in Nigeria, which offers great long-term volume potential despite the high risk it may present. For example, the unit price of bottled water in Nigeria is extremely low and it will certainly take a long time to recoup the initial investment.

Challenges

Overall, both Danone and Nestlé are operating in a growth HW market, thus, the direction of development toward health and wellness and nutrition is on the right track and fits well with the global consumer demand or aspiration for such foods and beverage with health credentials.

Both companies put a great deal of emphasis on research and development in terms of ingredients and/or packaging. Aside from the economic uncertainty and geopolitical unpredictability, which are beyond their control, both companies are facing increasingly strict legislation that might affect the direction of certain HW categories’ movement. For example, some companies are looking for superfruits, super-grains or super-insects as potential food ingredients. All money spent on research and development cannot guarantee commercial success. Also, increasing discussion of the sugar tax on sugarized foods and beverages prompted the search for “super sweeteners,” either natural or a blend of natural or artificial. It is at times a challenge to maintain the balance between taste and health.

For further insight contact Ewa Hudson, Global Head of Health and Wellness Research at Euromonitor International, at ewa.hudson@euromonitor.com; http://blog.euromonitor.com/