Columns

Medically Necessary Foods: Pricing & Reimbursement Considerations

Navigating the large and growing medical foods market requires understanding key dynamics.

By: Gregory Stephens

In healthcare settings, a wide range of nutrition products cross multiple regulatory categories, including medical foods, dietary supplements, conventional foods (e.g., fortified snacks), and foods for special dietary use (FSDU). These products are collectively referred to as “clinical nutritionals.” Increasingly, these products are used for disease-specific indications, falling into the medical food regulatory category.

An article in Nutrition in Clinical Practice provided a glimpse into early use of clinical nutritionals or medical foods (2006 Aug;21(4):411-5). When U.S. President James Garfield was shot in 1881 by Charles Guiteau, Garfield survived for 79 days. He was given rectal feedings of mixed whiskey and partially hydrolyzed beef and beef broth every four hours for most of that time. Certainly, the sophistication of formulations and route of administration have advanced since those days.

The medical food category originated in the 1940s in the U.S. Then, formulations of nutritious ingredients were made to provide elderly patients with healthy food that could be easily swallowed and digested. It helped to prolong life and slow the progress of age-related illness. Medical foods were commercially popularized soon after the 1960s, when special formulations were created to provide nutrition to infants with inborn errors of metabolism, specifically phenylketonuria (PKU). Throughout the 1980s and 1990s numerous medical foods were introduced addressing unique medical needs for diseases such as diabetes, renal disease, and chronic obstructive pulmonary disease (COPD).

Clinical Nutrition: A term referring to nutritional products that are intended to help patients or healthy people address specific health issues. From a regulatory standpoint, they may be categorized as medical foods, dietary supplements, foods for special dietary use, or conventional foods (e.g., meal replacement beverages).

Medical Foods: A distinct FDA regulatory category defined as foods that are specially formulated and intended for the dietary management of a disease that has distinctive nutritional requirements that cannot be met by the normal diet alone.

Taking the Pulse of the Market

Product and category sales referenced in this column are based on best available data and knowledge of the industry. Global sales of what is broadly referred to as medical foods are projected between $20 billion and $30 billion. Approximately half (50%) of these sales are standard meal replacement beverages (e.g., Ensure, Boost). Another 20% is products for the management of diabetes (e.g., Glucerna, Boost Glycemic Control). The remaining 30% comes from other disease products. Geographically, it is estimated that the U.S. represents 50% of the global market. The EU follows with approximately 25% of sales, with the “rest-of-world” at 25% (predominantly Asia and South America).

It is estimated that the three major players (Abbott Nutrition, Nestle Health Sciences, and Nutricia/Dannon) collectively control 60-80% of the U.S. medical food market. There are a few mid-sized medical food companies which register another 15-20% of sales, with an array of smaller and start-up companies with the remaining 5-15%.

The majority of medical food sales are to healthcare institutions: hospitals, nursing homes, and home care settings. Distribution to healthcare institutions is a wholesale model usually requiring a sizable professional field sales force. Also, gaining distribution in institutions or obtaining healthcare professional recommendations requires a higher level of clinical substantiation. The balance of non-institutional sales come from healthcare practitioners (offices or group practices), e-commerce, and F/D/M/C retail outlets (food, drug, mass market, and club stores).

Not surprisingly, a benefit of product usage in healthcare institutions, particularly in short-term stay, acute care settings, is the driving of “down-stream” retail sales (post-discharge). Before returning home, patients often receive a discharge kit with samples and/or coupons for the clinical nutritionals introduced in the hospital. The upside for post-discharge retail sales is so great that companies often sell products to hospitals at significantly discounted prices.

Product Pricing Considerations

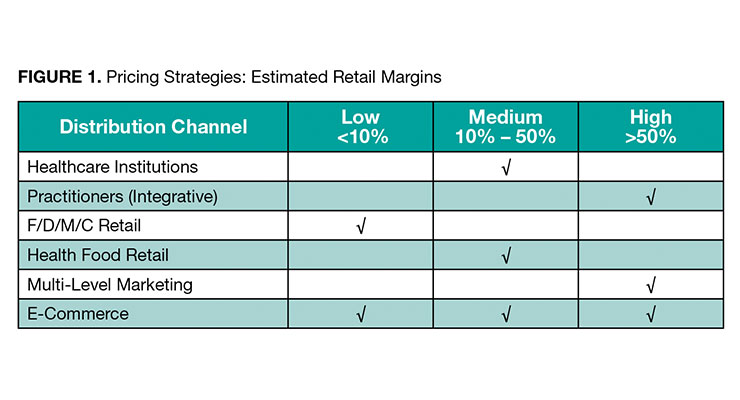

Pricing varies significantly with clinical nutrition products, affected by distribution channels, product quality, strength, purity and such issues as sustainability and transparency in sourcing. Highest price products are typically seen as those sold through the integrative health practitioner distribution channel. Multi-level marketing and some e-commerce sites also offer higher quality products (perceived or real) at higher consumer cost. Lower priced products are most often available in traditional F/D/M/C retail channels, in addition to some e-commerce products. Figure 1 depicts roughly estimated margins in each distribution channel.

Currently, there are no federal laws in the U.S. to mandate coverage for medically necessary foods. Some insurance policies will cover a medical food only if it has been demonstrated to provide 50% of total energy needs. While a physician’s order is not necessary to purchase a medical food, a physician must issue a written order that a medical food is medically necessary for treatment for it to have any chance of being covered by health insurance. Even when covered, essential medical foods are sometimes categorized as “second-” or “third-tier” drugs and have high out-of-pocket costs.

A patchwork of coverage exists for patients requiring them, resulting in gaps in reimbursement that lead to inadequate financial support for patients. On the public payer side, only 38 state Medicaid programs provide any medical food coverage, and many of these stop coverage at age 18. Medicare Part D also does not allow reimbursement for non-FDA-approved therapies, including medical foods. This leaves patients who require lifelong nutritional support, or the addition of clinical nutritionals later in life as adults, without coverage. Within commercial plans, when available, coverage is subject to limitations, including copayments, deductibles, and cost-sharing policies that apply to OTC products. As a result, patients are often burdened with significant out-of-pocket payments.

Looking forward, reimbursement for clinical nutritionals will increasingly face significant challenges. The lack of reimbursement can be attributed, at least in part, to differences in standards and regulations of scientific evidence required to support the marketing of medical food products compared to prescription drugs. Given that there are not clearly articulated and agreed upon regulatory standards to demonstrate efficacy or improved clinical outcome, reimbursement typically falls to the lowest common denominator of medical foods benefit: calories and essential nutrients to support growth.

This approach has successfully increased awareness for the need of medical foods in children with inborn error of metabolism of PKU. The cost of care for an untreated PKU patient has been shown to be approximately $200,000/year, while costs to provide adequate nutrition through clinical nutritionals are only an average of $15,000/year.

Still, the vast majority of medical foods are not reimbursed and must fit into the typical budgets of the hospital (e.g., Dietetics Department), which means they must be placed on the hospital formulary. Therefore, the clinical nutrition industry has taken the approach of running clinical trials that are meaningful to the targeted medical specialty and health systems to demonstrate value to the patient, and most importantly to demonstrate economic benefits of the medical food; however, this fragmentation of healthcare system coverages results in variations of what is accepted to meet reimbursement.

Strong evidence supporting medical foods may help to increase coverage from healthcare plans or provide data to encourage a national policy to address clinical nutritionals reimbursement. However, major changes in the current system of reimbursement are unlikely. And typically, the requirement by various health systems to get on their formularies are for multicenter trials and/or cost-effective outcomes.

Key Takeaways

- A few companies control the majority of market share. The remaining market is highly fragmented.

- Obtaining distribution in healthcare institutions or relying on healthcare professionals to recommend products requires a higher level of clinical substantiation than other channels.

- Marketing clinical nutrition products to healthcare institutions requires a significantly sized and well-trained sales force.

- Third-party reimbursement for clinical nutrition products is unlikely, unless sound clinical outcomes are demonstrated and/or cost/benefit has been confirmed through rigorous research.

- A benefit of product usage in healthcare institutions, particularly in short-term stay, acute care settings, is the driving of “down-stream,” post discharge retail sales.

- Product pricing varies between distribution channels.

About the Author: Greg Stephens, RD, is president of Windrose Partners, a company serving clients in the the dietary supplement, functional food and natural product industries. Formerly vice president of strategic consulting with The Natural Marketing Institute (NMI) and Vice President of Sales and Marketing for Nurture, Inc (OatVantage), he has 25 years of specialized expertise in the nutritional and pharmaceutical industries. His prior experience includes a progressive series of senior management positions with Abbott Nutrition (Ross Products Division of Abbott Laboratories), including development of global nutrition strategies for disease-specific growth platforms and business development for Abbott’s medical foods portfolio. He can be reached at 267-432-2696; E-mail: gregstephens@windrosepartners.com.